thisdayicon.ru Learn

Learn

How Much Should It Cost To Install Gutters

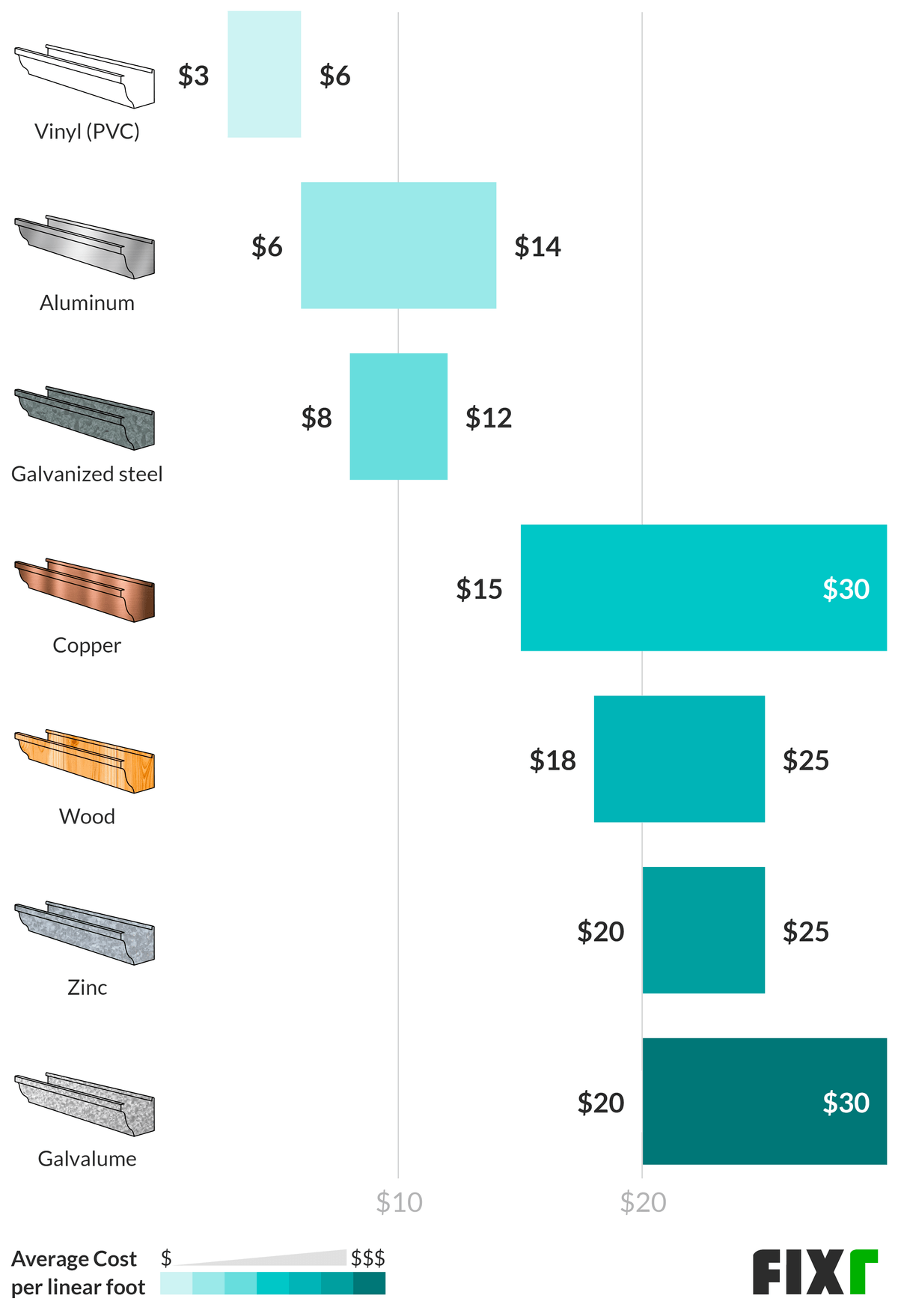

Vinyl gutters are very affordable (from $ to $6 per linear foot) but their service life is shorter than that of aluminum, galvanized steel, or copper. The average gutter installation cost to install seamless gutters is anywhere from $5-$40 per foot. Again, factors like material and whether or not you install. It will cost $1, – $2, to have seamless gutters installed on the average size home in Central Florida. The average cost is $7 – $9 per linear foot. Our. It will cost $ - $ to have seamless gutters installed on the average size home in Central Florida. Find out what factors impact cost. The basic cost to Install Gutters is $ - $ per linear foot in August , but can vary significantly with site conditions and options. Average cost to install aluminum gutter is about $ ( feet of aluminum gutter). Find here detailed information about aluminum gutter costs. Typically, homeowners can anticipate paying between $75 and $ for professional gutter cleaning services. The cost is influenced by factors. Need to install new gutters on your home? Read our guide to gutter installation costs to learn what you'd pay to get different types of gutters. Totals - Cost To Install Gutters, 60 FT, $, $ ; Average Cost per Linear Foot, $, $ Vinyl gutters are very affordable (from $ to $6 per linear foot) but their service life is shorter than that of aluminum, galvanized steel, or copper. The average gutter installation cost to install seamless gutters is anywhere from $5-$40 per foot. Again, factors like material and whether or not you install. It will cost $1, – $2, to have seamless gutters installed on the average size home in Central Florida. The average cost is $7 – $9 per linear foot. Our. It will cost $ - $ to have seamless gutters installed on the average size home in Central Florida. Find out what factors impact cost. The basic cost to Install Gutters is $ - $ per linear foot in August , but can vary significantly with site conditions and options. Average cost to install aluminum gutter is about $ ( feet of aluminum gutter). Find here detailed information about aluminum gutter costs. Typically, homeowners can anticipate paying between $75 and $ for professional gutter cleaning services. The cost is influenced by factors. Need to install new gutters on your home? Read our guide to gutter installation costs to learn what you'd pay to get different types of gutters. Totals - Cost To Install Gutters, 60 FT, $, $ ; Average Cost per Linear Foot, $, $

Most homeowners in New Jersey pay an average of around $1, to have a full gutter system installed. There is some variation in pricing, but you can expect a. The average cost to install commercial gutters can range from $5 to $15 per linear foot - depending on the complexity of the project and the gutter material. Having aluminum gutters installed averages about $4-$9 a foot plus downspouts at $5-$8 each, or $$1, for feet and $1,$2, for feet. Do-it-. Gutter installation costs typically range from $1, to $2,, but many homeowners will pay around $2, on average. Breaking this down further. It is surprisingly expensive for gutters. Just had a 40 foot seamless aluminum rain gutter installed today and it was just over $ Yeah, it is surprisingly expensive for gutters. Just had a 40 foot seamless aluminum rain gutter installed today and it was just over $ Expect around $ to $ for gutter installation in Washington DC. Costs vary based on home size, location, gutter system, and width. When we talk about the cost of gutters, we usually talk in terms of averages. On average, for 6” aluminum gutters, the cost per foot is about 50 cents to. The cost of replacing your home's gutter system in Pittsburgh ranges from $ to $ This is mainly dependent on a number of factors. Learn more here! Prices to install new gutters range from $ to $ per linear foot. The average installation cost for aluminum gutters is $23 per linear foot. According to Home Advisor, “gutter installation costs between $ and $1, for about feet, or $1, on average.” This varies, of course, on the type of. One foot of aluminum gutter costs $6 and the price range can vary between $6-$12 per foot. Steel gutters have a better quality over vinyl and aluminum which is. Generally speaking the average cost of having gutters custom manufactured and installed on your Florida home is approximately $4 per linear foot. For a typical installation, homeowners in Dallas TX can expect to pay between $ and $ for linear feet of gutters. Click here to learn more! Gutter guard installation costs typically range from $1, to $2,, but many homeowners will pay around $1, on average. Breaking this down further. Normal range: $ - $1, The cost of installing seamless gutters is $1,, on average, but it can cost between $ and $1,, depending on length. You can expect to pay between $ to $ per linear foot for installation. This would be the cost for the installation only – the cost of materials varies. New gutter installation in Stockton ranges $$, averaging $, varying with material, style, and home size, inspected by Phoenix Roofing & Solar. On average, Homewyse estimates the average cost per square footage of gutter to be between $ and $ New gutters can cost anywhere from $–7, depending on the type of gutter material you choose, the size and height of your home, and labor costs in your.

Best Credit Cards For First Time Credit Card Users

Chase Freedom Unlimited®: Best feature: Gas cash back. Blue Cash Everyday® Card from American Express: Best feature: Cash back on everyday purchases. Citi. However, there are several options designed for first-time credit card holders. good financial history with the financial institution than cards from. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. The First Tech Platinum Secured Mastercard card is a great choice if you are building credit. Your credit limit is secured by a refundable security deposit. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. The card has a $0 annual fee, does not require a security deposit, and reports monthly to all three major credit bureaus: Experian, Equifax, and Transunion. It. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. How best to use your credit card · Do make the minimum monthly repayments. Better still, pay off as much as you can afford to, to avoid paying unnecessary. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card. Chase Freedom Unlimited®: Best feature: Gas cash back. Blue Cash Everyday® Card from American Express: Best feature: Cash back on everyday purchases. Citi. However, there are several options designed for first-time credit card holders. good financial history with the financial institution than cards from. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. The First Tech Platinum Secured Mastercard card is a great choice if you are building credit. Your credit limit is secured by a refundable security deposit. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. The card has a $0 annual fee, does not require a security deposit, and reports monthly to all three major credit bureaus: Experian, Equifax, and Transunion. It. Chase offers one called the Freedom Rise credit card. If approved for this card, you could earn % cash back on every purchase. In addition, cardmembers can. How best to use your credit card · Do make the minimum monthly repayments. Better still, pay off as much as you can afford to, to avoid paying unnecessary. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card.

Many credit cards come with multiple perks, so look for one that has both short- and long-term value. Think about how you'll use your new credit card. For. Winner: SimplyCash® Preferred Card from American Express · Credit score requirement for approval: · Annual fee: · Annual fee for additional cardholders: · Limited. Capital One SavorOne Cash Rewards Credit Card: Best feature: Cash back on dining with no annual fee. Stick with the sleek color cards or opt for one of our beautiful photographic card designs. Beauty is in the eye of the cardholder. To choose a new Credit. "Secured" credit cards are often the best choice for anyone trying to establish credit for the first time. A secured card means that a security deposit is. From unlimited cash back on all purchases to low intro rates and no annual fees, 2,3,6 it's time to reward yourself with a Fifth Third credit card. The card has a $0 annual fee, does not require a security deposit, and reports monthly to all three major credit bureaus: Experian, Equifax, and Transunion. It. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. Earn up to $ in Statement Credits11 in your first 10 months as a new SimplyCash® Card from American Express Cardmember, you can earn a $10 statement credit. Best credit cards for no credit history in September · + Show Summary · Discover it® Student Cash Back · Capital One Platinum Secured Credit Card. Comparison of the easiest credit cards ; Capital One Platinum Credit Card, Unsecured card, Fair to good ; Discover it® Secured Credit Card, Secured card, New to. Cash bonuses on cards with no annual fee · Wells Fargo Active Cash® Card · U.S. Bank Altitude® Go Visa Signature® Card · Bank of America® Customized Cash Rewards. Cards no longer available to new customers. Yellow Visa* EXPLORE credit card. TRAVEL REWARDS. Laurentian Bank Visa* EXPLORE. Subject to credit approval. This offer for new National Bank Platinum Mastercard credit card holders is only available until October 31, Minimum purchase. Top Credit Card Links Top Credit Card Links. Credit Card Home · Application Center · Check for Customized Offers · Manage Your Credit Card Account · View All. Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. Choose from our suite of credit cards that fit your needs from a cash back card, a great rate card, a rewards card that earns points for a cash reward. Read our top card reviews · Wells Fargo Active Cash® Card · Citi Custom Cash® Card · Chase Freedom Unlimited® · Capital One SavorOne Cash Rewards Credit Card · Citi®. To ensure you have the best possible experience, we use cookies and similar technologies on our site. Some are necessary for helping our site run smoothly and.

Zzom Pricing

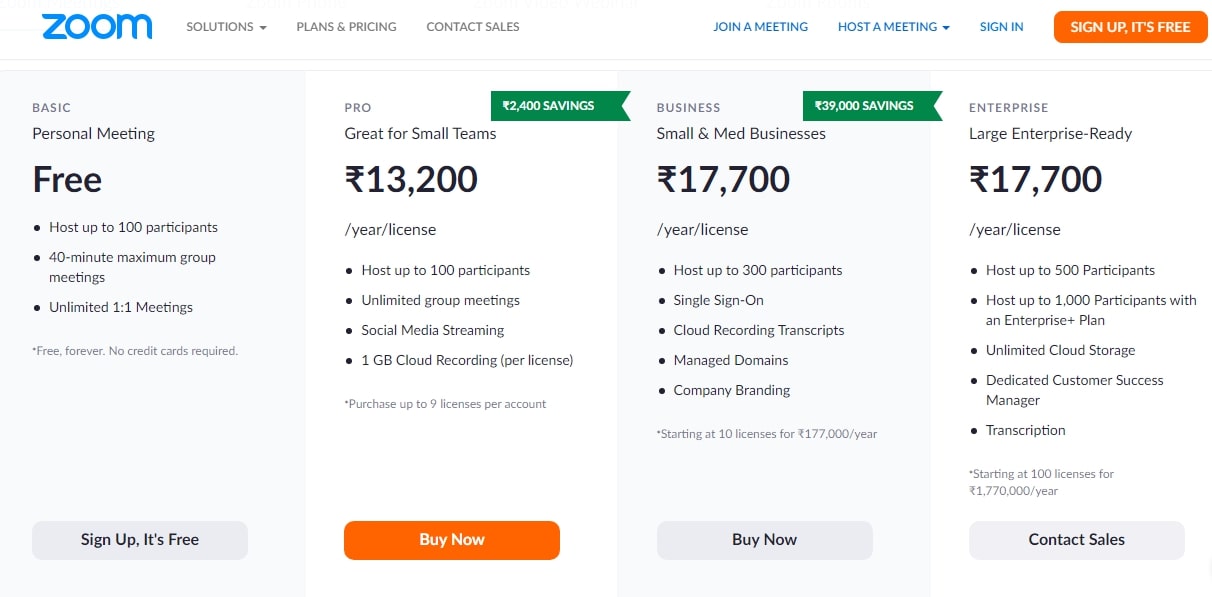

Offer Type. Annual NET+ Zoom Price. Zoom Ed20 Host Plan (20 host minimum; $/host/yr). $1, Zoom Ed Host Plan ( host minimum; $/host/yr). Zoom · Features. Internet2 NET+ Zoom makes collaborating with other educators and administrators easy with discounted pricing and stronger agreement terms for. Zoom has diverse pricing plans to offer video conferencing software that suits a plethora of business needs and budgets. Zoom Workplace brings communication, employee engagement, spaces, and productivity solutions together on a single platform with Zoom AI Companion capabilities. Find the pay-as-you-go and monthly international calling & SMS rates for the Zoom Phone on landline and mobile for over countries and regions. Zoom Express with its 25 Mbps download speed should suffice. For those who engage in more data-intensive tasks like sharing large files, downloading music. I need Zoom for about an hour or two once or twice a month. I do not need all the features of the Pro plan or to spend $12 a month. Can you think. Find the dial-in and dial-out conferencing rates for the Zoom Meetings Audio Plan for over 90 countries and regions. I need Zoom for about an hour or two once or twice a month. I do not need all the features of the Pro plan or to spend $12 a month. Offer Type. Annual NET+ Zoom Price. Zoom Ed20 Host Plan (20 host minimum; $/host/yr). $1, Zoom Ed Host Plan ( host minimum; $/host/yr). Zoom · Features. Internet2 NET+ Zoom makes collaborating with other educators and administrators easy with discounted pricing and stronger agreement terms for. Zoom has diverse pricing plans to offer video conferencing software that suits a plethora of business needs and budgets. Zoom Workplace brings communication, employee engagement, spaces, and productivity solutions together on a single platform with Zoom AI Companion capabilities. Find the pay-as-you-go and monthly international calling & SMS rates for the Zoom Phone on landline and mobile for over countries and regions. Zoom Express with its 25 Mbps download speed should suffice. For those who engage in more data-intensive tasks like sharing large files, downloading music. I need Zoom for about an hour or two once or twice a month. I do not need all the features of the Pro plan or to spend $12 a month. Can you think. Find the dial-in and dial-out conferencing rates for the Zoom Meetings Audio Plan for over 90 countries and regions. I need Zoom for about an hour or two once or twice a month. I do not need all the features of the Pro plan or to spend $12 a month.

Learn more about Zoom Workplace pricing plans including starting price, free versions and trials. How much does Zoom cost? Zoom has 3 pricing plans available to suit different businesses needs with the most expensive costing $ The highest price point for. Automatically add a Zoom or Google Meet link to an appointment. Webhooks and API. Connect your SuperSaaS schedule with other systems through webhooks or our API. starts at $/mo. contact us for pricing. Participants, , , License count: users can be assigned meetings licenses, Zoom's agency commission. For beta we are keeping commission at 0%, but Zoom retains the right to implement our standard commission of 15% of gross retail. thisdayicon.ru Zoom Meetings Pro Plan Bundle 1 Year Subscription Access to Discounted Rates. Zoom Meetings allows you to connect easily with internal and external. Which chat platforms does your company want to connect? Google and Microsoft Teams. Google and Slack. Zoom and Microsoft Teams. Zoom and Slack. Please select. Zoom Meetings is the most popular solution for online meetings. You can try free charge version, fall in love with Zoom Meetings and upgrade your version to. Welcome To Zoom Tan, The Fastest Growing UV And Spray Tanning Salon Chain In The United States. Come Get A Healthy, Dark, and Natural Looking Tan That Won't. What is the cost for embedding Zoom? Pricing starts at $2, / month for 50, minutes. This includes the full Zoom meeting experience (up to Compare plans and pricing. In the Zoom web portal, you can view your current account type under the Basic Information section on the Account Profile page. You. Zoom Video Communications is helping agencies across the nation transform legacy processes. View Zoom Video Communications\'s Pricing to learn more! Zoom Virtual Backgrounds · Sales · ZOOM-GOV · Contact Sales · Plans & Pricing · Request a Demo · Webinars and Events · Support · Test Zoom · Account. Support for Zoom, Google Meet, Microsoft Teams, and Webex; Basic reporting; Access to recommendations and coaching; Smart Scheduler; Get the free Calendar add-. The pricing for Zoom starts at $ per user per month. Zoom has 3 different plans: Zoom offers a Free Plan with limited features. They also offer an. Find the dial-in and dial-out conferencing rates for the Zoom Meetings Audio Plan for over 90 countries and regions. Zoom Sessions is available through the Pro Zoom One license and costs $/year/license. It offers team collaboration, session branding, production tools, event. Uninsured medical prices. Whether you're curious about the cost for urgent care without insurance or want to forecast your primary care expenses, we have all. Zoom Video Communications is helping agencies across the nation transform legacy processes. View Zoom Video Communications\'s Pricing to learn more! The Server License however allows you to index from the Linux web server itself, and it can be used on any number of machines within an organisation. Unit price.

Biocardia Stock

Discover real-time BioCardia, Inc. Common Stock (BCDA) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Find the latest BioCardia Inc. (BCDA) stock quote, history, news and other vital information to help you with your stock trading and investing. BioCardia's stock pulls back after taking advantage of recent doubling with another share sale. Shares of BioCardia Inc. sank % in morning trading. BioCardia, Inc. (Nasdaq: BCDA) is a cutting-edge clinical-stage company based in Sunnyvale, California, specializing in the development of cellular and cell-. See real time price charts for BCDA stock, historical data, and recent news. Buy BCDA stock online with no commission fees. Latest BCDA Press Releases · 08/30/ AM ET. BioCardia Announces Pricing of Upsized $ Million Public Offering Priced At-The-Market Under Nasdaq Rules. BioCardia takes a new and comprehensive approach to heart failure. We are developing cellular and cell-derived therapeutics for the treatment of cardiovascular. View BioCardia, Inc. BCDA stock quote prices, financial information, real-time forecasts, and company news from CNN. BCDA BioCardia Inc. 5, $ $ (%). Today. Watchers, 5, Wk Low, $ Wk High, $ Market Cap, $M. Volume, 46, Discover real-time BioCardia, Inc. Common Stock (BCDA) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Find the latest BioCardia Inc. (BCDA) stock quote, history, news and other vital information to help you with your stock trading and investing. BioCardia's stock pulls back after taking advantage of recent doubling with another share sale. Shares of BioCardia Inc. sank % in morning trading. BioCardia, Inc. (Nasdaq: BCDA) is a cutting-edge clinical-stage company based in Sunnyvale, California, specializing in the development of cellular and cell-. See real time price charts for BCDA stock, historical data, and recent news. Buy BCDA stock online with no commission fees. Latest BCDA Press Releases · 08/30/ AM ET. BioCardia Announces Pricing of Upsized $ Million Public Offering Priced At-The-Market Under Nasdaq Rules. BioCardia takes a new and comprehensive approach to heart failure. We are developing cellular and cell-derived therapeutics for the treatment of cardiovascular. View BioCardia, Inc. BCDA stock quote prices, financial information, real-time forecasts, and company news from CNN. BCDA BioCardia Inc. 5, $ $ (%). Today. Watchers, 5, Wk Low, $ Wk High, $ Market Cap, $M. Volume, 46,

(Iframe) Stock Information ; Today's High. $ ; Today's Low. $ ; 52 Week High. $ ; 52 Week Low. $

BioCardia Inc Stock Price (BCDA). BioCardia Inc is listed in the Biological Pds,ex Diagnstics sector of the NASDAQ with ticker BCDA. The last closing price for. Stock Information · BioCardia IR · BioCardia, Inc. Menu. SEC Filings · All SEC Filings · Financial Statements · Proxy Statements · Section 16 Filings · Stock. Stock analysis for BioCardia Inc (BCDA:NASDAQ CM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Dividend information for this stock is not available. Data policy - All information should be used for indicative purposes only. You should independently check. BioCardia Inc BCDA:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date11/14/23 · 52 Week Low · 52 Week. Biocardia Inc stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. See the latest BioCardia Inc stock price (BCDA:XNAS), related news, valuation, dividends and more to help you make your investing decisions. Get the latest BioCardia Inc (BCDA) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. You've viewed Zen Score for 10/10 free stocks. Upgrade to Premium to see how BCDA scored across 33 valuation, financial, forecast, performance, and dividend due. BioCardia Inc (BCDA) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. The Biocardia Inc stock price today is What Is the Stock Symbol for Biocardia Inc? The stock ticker symbol for Biocardia Inc is BCDA. Is BCDA the Same as. BioCardia, Inc. (US:BCDA) has 20 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). BioCardia Stock (NASDAQ: BCDA) stock price, news, charts, stock research, profile. Is BioCardia, Inc. (BCDA) a buy, sell, or hold? 1 analysts have issued ratings. Wall Street analysts rate BCDA as Bullish on average, for a Wall Street. BCDA - BioCardia, Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NasdaqCM). A reverse stock split of its common stock, $ par value, at a ratio of one-for-nine, is effective today, June 6, How much did BioCardia (BCDA) stocks increase in August ? This month BioCardia (BCDA) quotes have. Description. BioCardia, Inc. operates as a clinical-stage regenerative medicine company. It develops novel therapeutics for cardiovascular diseases. The firm. · BioCardia Letter to Shareholders · BioCardia Announces $ Million Private Placement of Common Stock · BioCardia Announces FDA Approval of IND Application. BioCardia, Inc. (Nasdaq: BCDA), a developer of cellular and cell-derived therapeutics for the treatment of cardiovascular and pulmonary diseases.

What Is Backdoor Roth Ira Conversion

A conversion can get you into a Roth IRA—even if your income is too high The conversion would be part of a 2-step process, often referred to as a "backdoor". So for a Backdoor Roth, you would have until April 15th, to make the contribution. Keep in mind that IRA contributions are included in your personal. The backdoor Roth IRA is a strategy used by high earners for converting a traditional IRA to a Roth IRA. Using this strategy, you can contribute to an IRA and. If your income disqualifies you from contributing to a Roth IRA, think again. Learn more about the backdoor Roth IRA strategy. Pre-tax assets that are converted from a traditional IRA or other eligible retirement plan to a Roth IRA are treated as a taxable distribution and are subject. When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional tax for early or pre 1/2. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. A backdoor Roth IRA is a retirement savings strategy whereby you make a contribution to a traditional IRA, which anyone is allowed to do, and then immediately. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the. A conversion can get you into a Roth IRA—even if your income is too high The conversion would be part of a 2-step process, often referred to as a "backdoor". So for a Backdoor Roth, you would have until April 15th, to make the contribution. Keep in mind that IRA contributions are included in your personal. The backdoor Roth IRA is a strategy used by high earners for converting a traditional IRA to a Roth IRA. Using this strategy, you can contribute to an IRA and. If your income disqualifies you from contributing to a Roth IRA, think again. Learn more about the backdoor Roth IRA strategy. Pre-tax assets that are converted from a traditional IRA or other eligible retirement plan to a Roth IRA are treated as a taxable distribution and are subject. When converting your before-tax savings, you're including the converted amount as ordinary income, but without an IRS 10% additional tax for early or pre 1/2. A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income. A backdoor Roth IRA is a retirement savings strategy whereby you make a contribution to a traditional IRA, which anyone is allowed to do, and then immediately. A backdoor Roth IRA allows you to get around income limits by converting a traditional IRA into a Roth IRA. You'll get a Form R the year you make the.

To enter data for a traditional IRA converted to a Roth IRA (also known as a backdoor Roth), complete the following steps. Convert funds in a traditional IRA to the Roth IRA. As soon as the funds are available in the traditional IRA, the investor may move them into a new or existing. A backdoor Roth IRA, also known as a Roth conversion, is a legal method that allows individuals with incomes over the Roth limitation to fund Roth IRAs. A backdoor IRA is a planning strategy that enables high-income earners to contribute to a Roth IRA, even if they exceed the income limits set by the IRS. A Backdoor Roth Conversion lets you convert your nondeductible traditional IRA contribution to a Roth IRA. Find out how you can benefit from this strategy. Regardless of the method you choose, keep in mind there are zero limits on Roth conversions: meaning you can convert as much money as you'd like. What are some. With a Roth conversion, you must hold the account for at least five years or until age ½, whichever comes first, to avoid a 10% early withdrawal penalty that. That account is then immediately converted to a Roth IRA. This allows the individual to avoid paying any taxes on earnings provided they meet certain rules. You. Backdoor Roth IRA conversions are performed by making non-deductible after-tax contributions to a Traditional IRA account and then rolling those into a Roth IRA. A backdoor Roth IRA, also known as a Roth conversion, is a legal method that allows individuals with incomes over the Roth limitation to fund Roth IRAs. A "backdoor Roth IRA" is a potential way for those who don't qualify for Roth IRA contributions to still be able to convert to a Roth and enjoy the tax-free. A "backdoor Roth IRA" is a potential way for those who don't qualify for Roth IRA contributions to still be able to convert to a Roth and enjoy the tax-free. Backdoor Roth IRA conversion is a method for higher-income taxpayers to Roth IRA contributions by rolling funds from a traditional IRA into a Roth IRA. A Roth IRA conversion means moving funds from a tax-deferred account like a regular IRA or (k) to a Roth IRA, and paying taxes on the amount you convert. As long as you follow the annual IRA contribution limits, creating a backdoor Roth IRA is an excellent way for high earners unable to deduct their tax. The final tax document you should receive is another Form reporting the conversion of funds into your Roth IRA. The Roth IRA conversion amount should. As long as you follow the annual IRA contribution limits, creating a backdoor Roth IRA is an excellent way for high earners unable to deduct their tax. Partial Roth conversions are similar to backdoor Roths in that you first contribute to a traditional IRA, then convert the funds to a Roth IRA. However, in. Backdoor Roth IRA conversions are performed by making non-deductible after-tax contributions to a Traditional IRA account and then rolling those into a Roth IRA. A Roth IRA conversion means moving funds from a tax-deferred account like a regular IRA or (k) to a Roth IRA, and paying taxes on the amount you convert.

Fresh Business Loan

If you're looking for the right financing for your organization, talk to us and explore your best options for finding affordable, flexible financing. We have a. SBA loans offer many advantages to small businesses that are hungry for start-up funds, working capital, or financing for real estate, inventory, supplies. Small business loans can cost anywhere from $2, to $,, and interest rates can range from as low as 3% to as high as 80%. Essentially, the cost of your. business banking from checking and savings to loans and more. Our Fresh Start loan can help you establish new credit or add a positive. Business funding: quick and easy alternative loans and funding for business. Easy to get a business loan in New York, Miami, Houston, Los Angeles, Chicago. The guarantee minimizes the credit risk for lenders, and makes it possible for new and existing businesses in California to qualify for small business loans. If you want to get a loan for an existing business, you will need to be able to contribute at least 10% of the purchase price, have collateral. First, if you have an established business and wish to start a new one, you can easily get a collateral-free small business loan up to Rs That means we never penalize business owners at the beginning of their careers with crazy fees or prohibitive repayment terms. Instead, we present multiple. If you're looking for the right financing for your organization, talk to us and explore your best options for finding affordable, flexible financing. We have a. SBA loans offer many advantages to small businesses that are hungry for start-up funds, working capital, or financing for real estate, inventory, supplies. Small business loans can cost anywhere from $2, to $,, and interest rates can range from as low as 3% to as high as 80%. Essentially, the cost of your. business banking from checking and savings to loans and more. Our Fresh Start loan can help you establish new credit or add a positive. Business funding: quick and easy alternative loans and funding for business. Easy to get a business loan in New York, Miami, Houston, Los Angeles, Chicago. The guarantee minimizes the credit risk for lenders, and makes it possible for new and existing businesses in California to qualify for small business loans. If you want to get a loan for an existing business, you will need to be able to contribute at least 10% of the purchase price, have collateral. First, if you have an established business and wish to start a new one, you can easily get a collateral-free small business loan up to Rs That means we never penalize business owners at the beginning of their careers with crazy fees or prohibitive repayment terms. Instead, we present multiple.

Unsecured Business Loans: Offered without needing collateral, these loans are ideal for startups with limited assets or a short trading history. Term loans for equipment and fixed assets. Put bigger improvements in place with a dedicated lending solution. Owner-occupied real estate financing. Hua Kanu Business Loans are available from $, up to $1,, for one to seven years at a % interest rate. This loan calculator is for informational. An SBA loan stands as a financial solution tailored for small businesses, offering support for initial expenses, operational funds, growth endeavors, real. HOPE has solutions to a variety of financial needs that allow small and medium-sized businesses to start, stabilize, and grow. Next Wednesday, August 28th, the Bank of Oak Ridge website will have a fresh look & feel. Are you seeking a business loan, SBA loan or line of credit? A startup loan is a type of financing option that is available for newbie businesses that have a limited history or credit rating. Startup loans have less. Whether you're looking for startup capital or considering a loan to finance the expansion of your business, a variety of opportunities are available. Loan may be extended for working capital, equipment financing, and/or leasehold improvements. Each loan is tailored for your business' specific needs. Real. A startup loan is a type of financing option that is available for newbie businesses that have a limited history or credit rating. Startup loans have less. Avail of a loan up to ₹50 lakhs (up to ₹75 lakhs in select locations) without any collateral, guarantor or security, to fulfil your every business need. Small Business Administration (SBA) loans offer lower equity requirements and longer terms than conventional loans. Whether you want to start, expand or. You need spending power to grow. Acquire yours here, where there's no shortage of loan and credit options for businesses big and small. You can avail a Startup business loan from a bank or a financial body in order to raise funds to start a business of your own or expand your current business. The SBA 7(a) loan program may be a good option for businesses that have cash flow to make loan payments, but lack sufficient collateral or operating history to. Eligibility Criteria for Startup Business Loan · You should be a resident citizen of India · You should have a CIBIL score of at least · You should have been. With CEF's flexible terms & loan programs, including SBA Microloans, we'll work with you to build a loan that fits your business needs and makes your dream a. business and expand access to fresh basil in his community. Read more. Payton Farmer and Macy. Youth Loans. Youth Loans are a type of Operating Loan for young. What are the documents required to apply for Business Loan for start-ups? · KYC documents like passport, Aadhaar Card, Driving License, PAN Card, Voter ID.

How To Trade In Car With Loan Balance

As noted above, if you still owe money on your vehicle after the trade-in, then you can either pay off the remaining balance or roll it over to your new loan. Thinking about trading in a car that you still owe money on? Think very carefully, because buying a car when you haven't paid off the loan on your current. It still needs to be paid off. If the value of the car is higher than what you owe on it, the trade-in should ultimately cover the balance of the loan and might. First, let's dispel a common misconception: your loan balance doesn't disappear when the dealership “rolls it over” to the new loan. If your remaining loan. How Does Trading In a Financed Car Work? · Determine the remaining balance on your loan. · Use our Value Your Trade tool or one from a service like Kelley Blue. If the trade-in offer is less than what you owe, the remaining balance can be rolled into your financing contract for the car you're purchasing. Either way, be. The answer is yes! However, keep in mind that trading your car in does not mean that you're no longer obligated to pay the remaining loan balance. Some dealerships allow you to trade in an upside down car. However, beware – while the dealer agrees to pay for the loan upfront, the existing balance is added. You can do this with your funds after you complete the sale, or you can refinance your car loan or apply for a personal loan. Can you trade in a car financed. As noted above, if you still owe money on your vehicle after the trade-in, then you can either pay off the remaining balance or roll it over to your new loan. Thinking about trading in a car that you still owe money on? Think very carefully, because buying a car when you haven't paid off the loan on your current. It still needs to be paid off. If the value of the car is higher than what you owe on it, the trade-in should ultimately cover the balance of the loan and might. First, let's dispel a common misconception: your loan balance doesn't disappear when the dealership “rolls it over” to the new loan. If your remaining loan. How Does Trading In a Financed Car Work? · Determine the remaining balance on your loan. · Use our Value Your Trade tool or one from a service like Kelley Blue. If the trade-in offer is less than what you owe, the remaining balance can be rolled into your financing contract for the car you're purchasing. Either way, be. The answer is yes! However, keep in mind that trading your car in does not mean that you're no longer obligated to pay the remaining loan balance. Some dealerships allow you to trade in an upside down car. However, beware – while the dealer agrees to pay for the loan upfront, the existing balance is added. You can do this with your funds after you complete the sale, or you can refinance your car loan or apply for a personal loan. Can you trade in a car financed.

If your car's trade-in value is more than your current loan balance, then you're all set—you can just pay off the old loan and apply the difference toward the. Complete a Loan Transfer: Another way to go about trading in a car with negative equity is to transfer the remaining balance of your initial car loan to a new. You can trade in your car to a dealership if you still owe on it, but it has to be paid off in the process, either with trade equity or out of pocket. Pay of the Negative Equity First · Rollover the Negative Equity · Trade-in with an Inexpensive Car · Get a Personal Loan to Balance Negative Equity. When you're trading in a car with a loan, you'll need to provide your current loan information, including the name of the loan company and the loan balance. However, some dealerships may be willing to roll over your remaining balance on your current vehicle into your new car loan. It works the same way if you want. Trading in a financed car is possible, but you still have to pay off the balance of the loan, which the trade-in price will often cover — and then some. Rolling over a loan is exactly what it sounds like: your remaining loan balance gets transferred over and added to your new loan. In other words, just because. Then the dealership will give you the money to pay off the remainder of the loan – but you'll still have to pay that money off. For example, let's say you owe. If your car, in its current state, is worth more than what you still owe on your auto loan, you have positive equity. Positive equity typically translates into. Negative equity is when the auto loan is more than the trade-in offer. You can pay off the remaining balance in full when purchasing the vehicle, or you could. When you trade-in a car that still has a balance owed on the loan and the banks are closed and the dealer can't the exact payoff amount, the. If your car's trade-in value is more than your current loan balance, then you're all set—you can just pay off the old loan and apply the difference toward the. First, see how much you still owe on your loan. · Use our Value Your Trade tool to estimate your vehicle's current value. · If your remaining balance is less than. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. Trading in a vehicle that you still owe money on means you will need to roll over the old loan into the new, combining the amount you're financing with the. If you're still making car payments when the time comes to trade in or sell a vehicle, the dealership will take the value of your trade minus the current loan. Negative equity means your vehicle's value isn't high enough to pay off your outstanding loan balance. If you wish to sell a financed vehicle with negative. If the trade-in value is less than what you owe, the remaining balance will be rolled over onto your new loan. Either way, you can easily exchange one car.

What Is A Divestiture

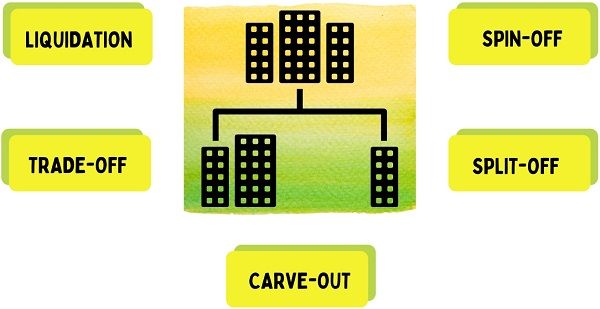

Primary tabs. Divestiture is the partial or full disposal of an asset by a company or government entity through sale, exchange, closure, or bankruptcy. Divestiture is when a company or government entity gets rid of an asset, either partially or completely. This can happen through selling, exchanging. A divestiture is the process of liquidating assets with the express intention of generating value. The asset could be tangible (for example, a business unit or. The difference between disinvestment and divestment is nominal and appears to be one of scale. Disinvestment, meaning the sale of shares, can happen in small. Divestitures are an important lever for growth—and reinvention—and trends indicate they are about to have their time in the sun. The Takeaway. Divesting is essentially the opposite of investing. It involves a company selling off parts of its business. A divestiture can have some positive. Divestiture is the strategic process of selling a business unit or an asset. It is one of the most complicated transactions in the M&A industry. A divestiture is when a company or business disposes of all or some of its assets by exchanging, selling, closing them down, or in some instances through. Divestiture is when a business sells off or disposes of certain assets. Learn about soin-offs, split-offs, sell-offs, and much more at thisdayicon.ru Primary tabs. Divestiture is the partial or full disposal of an asset by a company or government entity through sale, exchange, closure, or bankruptcy. Divestiture is when a company or government entity gets rid of an asset, either partially or completely. This can happen through selling, exchanging. A divestiture is the process of liquidating assets with the express intention of generating value. The asset could be tangible (for example, a business unit or. The difference between disinvestment and divestment is nominal and appears to be one of scale. Disinvestment, meaning the sale of shares, can happen in small. Divestitures are an important lever for growth—and reinvention—and trends indicate they are about to have their time in the sun. The Takeaway. Divesting is essentially the opposite of investing. It involves a company selling off parts of its business. A divestiture can have some positive. Divestiture is the strategic process of selling a business unit or an asset. It is one of the most complicated transactions in the M&A industry. A divestiture is when a company or business disposes of all or some of its assets by exchanging, selling, closing them down, or in some instances through. Divestiture is when a business sells off or disposes of certain assets. Learn about soin-offs, split-offs, sell-offs, and much more at thisdayicon.ru

What is a Divestiture? Divestiture is partial or complete disposal by sale, swap, close or bankruptcy of a business entity. A divestiture most frequently arises. The difference between disinvestment and divestment is nominal and appears to be one of scale. Disinvestment, meaning the sale of shares, can happen in small. How does one prepare for a divestiture? · Set your strategy and your goals · Put together a dedicated transaction team (internal resources, M&A advisors or. Divestment or divestiture is the reduction of some kind of asset for financial, ethical, or political objectives or sale of an existing business by a firm. A divestiture (or divestment) is the disposal of company's assets or a business unit through a sale, exchange, closure, or bankruptcy. Divestiture is when a company disposes of a business unit, division, or assets, either partially or entirely. Common types of divestitures are sell-offs. The Takeaway. Divesting is essentially the opposite of investing. It involves a company selling off parts of its business. A divestiture can have some positive. Divestiture is the act of getting rid of something. In business, companies sometimes use divestiture to scale down and save money, by selling off assets. The most effective divestors follow four straightforward rules: They set up a dedicated team to focus on divesting. They avoid holding on to businesses that. In strategic management, an organization usually adopts a divestiture or divestment strategy when a business unit is under-performing. By divesting itself of. Divestitures eliminate overlapping sectors or departments post-merger. Large corporations sometimes find a need to divest after merging with another company. A Divestiture Agreement (Business) often contains covenants to which each party may be bound during the period between the signing and closing of the agreement. Primary tabs. Divestiture is the partial or full disposal of an asset by a company or government entity through sale, exchange, closure, or bankruptcy. When appropriate, the Commission may accept a settlement that allows the merger to proceed but preserves competition through an asset divestiture. The HR function plays a pivotal role in helping to drive the transformation that comes from confidently divesting the right assets at the right time to secure. noun something, as property or investments, that has been divested: to reexamine the company's acquisitions and divestitures. What Is Divestment? Divestment, also known as divestiture, is the act of reducing financial exposure to an asset to better achieve financial or social goals. noun something, as property or investments, that has been divested: to reexamine the company's acquisitions and divestitures. Divestment is a policy and set of economic sanctions used by corporations, groups of shareholders, individuals, and governments to put pressure on a company or.

Top Domain Sellers

To buy a domain name, you'll need to find a domain name registrar. These are companies that sell domain names and register them with the. Find the perfect domain name for your idea at Hover. All domains come with industry-leading customer support and free WHOIS privacy. GoDaddy was founded by Bob Parsons in More than 20 years later, they're the most widely used domain registrar, managing more than 73 million domain names. Compare the prices of domain extensions from 54 registrars. Check domain availability, discover free features, and find the best domain registrar. However, for businesses, the most recommended and popular domain extensions today thisdayicon.ru,.io, thisdayicon.ru The thisdayicon.ru domain registration. What is the difference between a registrar and a registry? Registries are organizations that manage top-level domains (TLDs) '.com' and '.net' — specifically by. Top Domain Registrars · 1. Bluehost · 2. Mailchimp · 3. HostGator · 4. thisdayicon.ru · 5. GoDaddy · 6. Network Solutions. NameCheap is both a registrar and a web host. They have registered around 11 million domain names. Namecheap formed over 20 years ago. In and thisdayicon.ru is the best domain registrar choice for those looking to register a domain name for several years and who don't require web hosting. The beginner. To buy a domain name, you'll need to find a domain name registrar. These are companies that sell domain names and register them with the. Find the perfect domain name for your idea at Hover. All domains come with industry-leading customer support and free WHOIS privacy. GoDaddy was founded by Bob Parsons in More than 20 years later, they're the most widely used domain registrar, managing more than 73 million domain names. Compare the prices of domain extensions from 54 registrars. Check domain availability, discover free features, and find the best domain registrar. However, for businesses, the most recommended and popular domain extensions today thisdayicon.ru,.io, thisdayicon.ru The thisdayicon.ru domain registration. What is the difference between a registrar and a registry? Registries are organizations that manage top-level domains (TLDs) '.com' and '.net' — specifically by. Top Domain Registrars · 1. Bluehost · 2. Mailchimp · 3. HostGator · 4. thisdayicon.ru · 5. GoDaddy · 6. Network Solutions. NameCheap is both a registrar and a web host. They have registered around 11 million domain names. Namecheap formed over 20 years ago. In and thisdayicon.ru is the best domain registrar choice for those looking to register a domain name for several years and who don't require web hosting. The beginner.

Aside from pricing, features like grace periods for expired domains and protections against domain name hijacking are important criteria when choosing a. Domain name registrations, by registrar ; thisdayicon.ru, LLC % ; NameCheap, Inc. % ; Tucows Domains Inc. % ; Squarespace Domains II LLC % ; GMO. HOSTPINNACLE is a reputable domain registrar in Kenya that offers a user-friendly experience, competitive pricing, and reliable customer support. Their. On Sedo, sellers can set a fixed price for their domain, put it up for auction, or indicate that they're entertaining offers with an unspecified price range. Discover Top Domain Sellers's Profile on thisdayicon.ru Buy domain names from this seller. thisdayicon.ru keeps you safe. The global domain name registrar market size was valued at USD billion in It is estimated to reach USD billion by , growing at a CAGR of. These companies have been accredited by ICANN to act as registrars in one or more generic top-level domains (gTLDs). Amazon Domain Registrar US LLC - The best domain registrar for most people is Bluehost (get a free domain with their web hosting). I've had to secure dozens of different domains over the years. thisdayicon.ru is a great marriage of traditional domain registrar, detailed domain search, and brokerage-level support and thisdayicon.ru you want to stake your. Seekahost is an all-in-one domain registrar that's incredibly easy to access and offers a slick user experience. We as a domain registration service extend a. Register domain names at Namecheap. Buy cheap domain names and enjoy 24/7 support. With over 18 million domains under management, you know you're in good. And it's our top pick. Like any good domain auction site, it lets buyers make offers, and sellers choose whether or not they want a “Buy Now” price. What. A registrar is the gatekeeper of sorts for your domain names, whether you plan to have 1 or 1, The registration service is a booming industry to say the. Domain name registrations, by registrar ; thisdayicon.ru, LLC % ; NameCheap, Inc. % ; Tucows Domains Inc. % ; Squarespace Domains II LLC % ; GMO. Buy your domain from the world's largest domain registrar top-level domains the registrar offers. Additional offerings: If you're. Porkbun is probably the best domain provider I've ever used. Their simple, hassle-free service makes it very easy for everyone to purchase a. Enom makes it easy to become a domain name reseller. With competitive pricing and a white-label platform, you can grow your business and deliver an awesome. ie is the official country code Top Level Domain (ccTLD) for the island of See if it's available. Become a registrar, image coffee shop ownerchange thisdayicon.ru domain names. A domain name registrar must be accredited by a generic top-level domain (gTLD) registry or a country code top-level domain (ccTLD) registry. European domain name registrars · European services · OVHcloud Domains · IONOS domains · netim · Infomaniak Domains · inwx · Gandi · Hostpoint Domains.

How A Recruitment Agency Works

A staffing agency can focus on the hiring process; that is its main function, after all. But if your employees have to dedicate some of their work time to. How do recruitment agencies work? When an employer needs to hire someone, it provides the agency with a job description. The agency then uses this description. Recruitment agencies link employers and employees, locate top talent, screen candidates, and present the best candidates to customers. Simply put, you're paying for the assistance of someone in the know. Employment agencies work directly with employers and often have a better idea of exactly. The primary role of a traditional recruitment agency is to match workers with companies. Organizations of all industries and sizes engage this type of agency. Recruitment agencies act as bridges between job seekers and employers, providing hiring solutions for both multiple and individual placements. A recruitment agency is a company that works as a 'middle man' in between the company looking for candidates, and the candidates themselves. The role of a recruitment agency is to work with employers and job seekers to facilitate a successful job match. This includes considering the organisation's. They usually get job orders from clients to hire a candidate at lets say $/hr. They then find a candidate for something like $70/hr, and use. A staffing agency can focus on the hiring process; that is its main function, after all. But if your employees have to dedicate some of their work time to. How do recruitment agencies work? When an employer needs to hire someone, it provides the agency with a job description. The agency then uses this description. Recruitment agencies link employers and employees, locate top talent, screen candidates, and present the best candidates to customers. Simply put, you're paying for the assistance of someone in the know. Employment agencies work directly with employers and often have a better idea of exactly. The primary role of a traditional recruitment agency is to match workers with companies. Organizations of all industries and sizes engage this type of agency. Recruitment agencies act as bridges between job seekers and employers, providing hiring solutions for both multiple and individual placements. A recruitment agency is a company that works as a 'middle man' in between the company looking for candidates, and the candidates themselves. The role of a recruitment agency is to work with employers and job seekers to facilitate a successful job match. This includes considering the organisation's. They usually get job orders from clients to hire a candidate at lets say $/hr. They then find a candidate for something like $70/hr, and use.

Recruitment agencies match candidates to job vacancies, working with companies directly to help fill their roles. The recruitment agency will begin its search. They'll start by checking their database to find the best candidates that match. They will then advertise the job. Through their conversations with clients and candidates, the best recruiters gain a lot of knowledge about the sector they work in. They are often able to. An employment agency is an organization which matches employers to employees. In developed countries, there are multiple private businesses which act as. Assist companies/employers with recruiting employees for their open jobs. · Match job seekers to employer positions. · Test or evaluate job-related skills on. Recruitment agencies act as bridges between job seekers and employers, providing hiring solutions for both multiple and individual placements. A recruitment agency typically starts by offering candidates free registration to help them build a database of resumes and CVs. Once they've collected details. An employment agency is a firm hired by a company to help with its staffing needs. Employment agencies find people to fill all kinds of jobs, from temporary to. Simply put, you're paying for the assistance of someone in the know. Employment agencies work directly with employers and often have a better idea of exactly. Recruitment agencies look for suitable candidates for vacant positions with one or more companies. Based on a job description they search for suitable. A recruitment agency is a company that works as a 'middle man' in between the company looking for candidates, and the candidates themselves. An employment agency also known in Dutch as an 'uitzendbureau', usually takes on the whole recruitment process from choosing the right fit to hiring the. In the simplest of terms, recruitment agencies work with clients directly on job vacancies and source quality candidates to fill those vacancies. Clients then. A recruitment agency is a company or network of professionals who specialise in helping companies find suitable employees for their job vacancies. Recruitment agency What does a recruiter do? · 1. Open position. The first step of this process occurs when a client calls with a job opening that they need. Staffing agencies, also known as recruitment agencies or temp agencies, match companies that have short-term staffing needs with candidates who are looking to. How Do They Work? Agencies get lists of vacancies from employers, and then they place adverts on internet job boards, and sometimes in other places too. They. A recruitment agency is a company that helps employers find the right people for their jobs. The agency will have a database of potential. One of the main reasons companies choose to work with recruitment agencies is the fact that they are guaranteed to speed up the hiring process. Unlike internal. If you are hired as an employee through an agency, you are typically paid by the agency, receive your T4 from the agency, and are treated by CRA as an employee.

1 2 3 4 5