thisdayicon.ru Overview

Overview

Workday Or Sap

With regards to HR software accessibility, Workday HCM does not have native mobile apps for Android and iOS, while SuccessFactors is slightly. Workday HCM is more expensive to implement (TCO) than SAP HCM, and Workday HCM is rated higher (98/) than SAP HCM (88/). SAP HCM offers users more. In summary, SAP provides a broad suite of integrated business applications covering various functions, whereas Workday specializes in cloud-based solutions. Two popular ERP solutions on the market are SAP and Workday. Both are known for their advanced functionality and scalability, but there are key differences. Workday has stronger reporting and self-service tools. On-premise SAP is infinitely stronger when it comes to customization. You can have your. Side-by-side comparison of Workday (86%) and SAP SuccessFactors (84%) including features, pricing, scores, reviews & trends. SAP SuccessFactors HCM has a rating of stars with reviews. Workday Human Capital Management has a rating of stars with reviews. See side-by-side. SAP rates % lower than Workday on Compensation Culture Ratings vs Workday Ratings based on looking at ratings from employees of the two companies. Ratings. However, Workday HCM has a more modern and streamlined interface, while SAP SuccessFactors has a more traditional look and feel. Finally, the. With regards to HR software accessibility, Workday HCM does not have native mobile apps for Android and iOS, while SuccessFactors is slightly. Workday HCM is more expensive to implement (TCO) than SAP HCM, and Workday HCM is rated higher (98/) than SAP HCM (88/). SAP HCM offers users more. In summary, SAP provides a broad suite of integrated business applications covering various functions, whereas Workday specializes in cloud-based solutions. Two popular ERP solutions on the market are SAP and Workday. Both are known for their advanced functionality and scalability, but there are key differences. Workday has stronger reporting and self-service tools. On-premise SAP is infinitely stronger when it comes to customization. You can have your. Side-by-side comparison of Workday (86%) and SAP SuccessFactors (84%) including features, pricing, scores, reviews & trends. SAP SuccessFactors HCM has a rating of stars with reviews. Workday Human Capital Management has a rating of stars with reviews. See side-by-side. SAP rates % lower than Workday on Compensation Culture Ratings vs Workday Ratings based on looking at ratings from employees of the two companies. Ratings. However, Workday HCM has a more modern and streamlined interface, while SAP SuccessFactors has a more traditional look and feel. Finally, the.

Workday has provided me the opportunity to grow today as SAP once did in ! I don't have a crystal ball but I have a good feeling about the. This depends on various factors, such as your requirements, costs, integrations, customer support, and more. However, based on customer ratings, Workday HCM has. Get a comparison of working at SAP vs Workday. Compare ratings, reviews, salaries, and work-life balance to make the right decision for your career. SAP has a rating of stars with reviews. Workday has a rating of stars with reviews. See side-by-side comparisons of product capabilities. SAP is ranked #3 with an average rating of , while Workday is ranked #2 with an average rating of SAP holds a % mindshare in CHCM, compared to. Workday has a % market share in the Human Capital Management category, while SAP HCM has a % market share in the same space. Other programs, such as SAP Business One, are good and all, but I feel like HCM is still a better interface than SAP even though I've called it clunky. It's. SAP SuccessFactors is praised for its comprehensive HR capabilities, customizable reporting, competitive pricing, and strong customer support. In conclusion, the choice between SAP SuccessFactors and Workday is a pivotal decision that hinges on your organization's unique needs and aspirations. While. Solution. Initially, the approach was for the SAP team to build an integration to make web service calls into Workday to get the worker information. Dispatch. Salaries. SAP has 3, more total submitted salaries than Workday. Development Architect. Salaries. Connect your existing Workday account to the ERP Hub, allowing you to manage staffing, recruiting, employees, etc. across multiple Employee Elements. The advantages of Workday over SAP are manifest in its ability to streamline operations, foster collaboration, and empower organisations to meet the dynamic. Compare Workday Human Capital Management and SAP SuccessFactors Human Experience Management Suite using real user data focused on features, satisfaction. Workday is providing a lot of opportunities. So give your best and try to learn it effectively to get hold of a job in a good organization. SAP SuccessFactors vs Workday HCM · Reviewers felt that Workday HCM meets the needs of their business better than SAP SuccessFactors. · When comparing quality. SAP SuccessFactors rates % lower than Workday on Leadership Culture Ratings vs Workday Ratings based on looking at ratings from employees of the two. Our Integration Framework is a pre-configured solution that supports End2End Business processes across Workday and SAP. Comparing the market share of Workday and SAP S/4HANA. Workday has a % market share in the Enterprise Resource Planning (ERP) category, while SAP S/4HANA. For feature updates and roadmaps, our reviewers preferred the direction of SAP SuccessFactors Employee Central Payroll over Workday HCM. Pricing. Entry-Level.

What Percentage To Pay Employees

Seasonal Worker Pay: Wages paid to temporary employees hired during peak times. Bonuses and Incentives: Performance-based, or discretionary payments that vary. A promotional increase must bring the employee to at least the minimum of their new salary range. The effective date of a promotion should coincide with the. sales running between 15 and 20 percent. The next step is to calculate the percentage for your own company. List all employee costs – benefits, salary and taxes. With finance and banking, bonuses can make up quite a large chunk of employee compensation packages, often reflecting personal and company performance. On. To calculate straight-time pay, multiply the number of hours the employee usually works by their hourly pay rate. If an employee makes $15 an hour and is. Which employees can be paid on a salary basis? Anyone can be paid on any basis – salary, hourly, commission, piece-rate, flat rate – as long as they receive. Deciding on pay is a balancing act · Work out what to pay your employees in five steps · 1. Write an accurate job description · 2. Get up-to-date salary data · 3. You collect the employee's portion of these taxes from the wages you pay your employee, or from funds the employee gives you. If you don't have enough money. You pay salaries, bonuses, commissions, vacation pay or tips to your employees. portion of the Canada Pension Plan and Employment Insurance contributions. Seasonal Worker Pay: Wages paid to temporary employees hired during peak times. Bonuses and Incentives: Performance-based, or discretionary payments that vary. A promotional increase must bring the employee to at least the minimum of their new salary range. The effective date of a promotion should coincide with the. sales running between 15 and 20 percent. The next step is to calculate the percentage for your own company. List all employee costs – benefits, salary and taxes. With finance and banking, bonuses can make up quite a large chunk of employee compensation packages, often reflecting personal and company performance. On. To calculate straight-time pay, multiply the number of hours the employee usually works by their hourly pay rate. If an employee makes $15 an hour and is. Which employees can be paid on a salary basis? Anyone can be paid on any basis – salary, hourly, commission, piece-rate, flat rate – as long as they receive. Deciding on pay is a balancing act · Work out what to pay your employees in five steps · 1. Write an accurate job description · 2. Get up-to-date salary data · 3. You collect the employee's portion of these taxes from the wages you pay your employee, or from funds the employee gives you. If you don't have enough money. You pay salaries, bonuses, commissions, vacation pay or tips to your employees. portion of the Canada Pension Plan and Employment Insurance contributions.

In , million hourly workers —% of all hourly workers — earned at or below the federal minimum wage. That's the lowest number since data collection. A promotional increase must bring the employee to at least the minimum of their new salary range. The effective date of a promotion should coincide with the. The restaurant industry faces a lot of industry-specific regulations on payroll, with laws regulating hourly employee scheduling and tipped wage workers, as. Divide your restaurant's labor cost by its annual revenue. For example, if the restaurant paid $, a year to its employees and brought in $1,, a year. When you divide these, you will get 20 percent, and that is how much goes to your payroll expenses. When determining the percentage for your employee's salary. Retirement and savings account for percent of their total cost, according to the US Department of Labor's June Employer Costs for Employee Compensation. Employees pay 60% of the contribution rate. For example, if an employee's paycheck totals $1,, they would pay $6 as their portion of the contribution rate. Deciding on pay is a balancing act · Work out what to pay your employees in five steps · 1. Write an accurate job description · 2. Get up-to-date salary data · 3. ➢ Retirement contributions. ➢ Longevity pay. Average Total Compensation. Package for a Classified, Full-time. Employee. $72, Salary. Start by calculating all of your employees' salaries and the average hours expected of your hourly employees. Include overtime pay when coming up with worker. Typically, labor cost percentages average 20 to 35 percent of gross sales. Appropriate percentages vary by industry, A service business might have an employee. If you decide to hire an external recruiter, you'll typically pay them a percentage of the new hire's base salary as a retainer fee, which can run anywhere from. Subtract the value above from your original salary to obtain your new salary amount. 55, minus 5, equals 49, The employee's new salary rate is $49, It can be used as a powerful recruitment tool if your benefits are good but your salary base is a bit low. It is also a good reminder to current employees as to. Starting Jan. 1, , the premium rate is percent of each employee's gross wages, not including tips, up to the Social Security cap ($,). The FLSA requires that most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than. Can we pay nonprofit employees a bonus? (See IRS Form instructions, pages ) Learn why paying a commission or percentage of funds raised to staff. Wage replacement refers to replacing lost employment income resulting from your workplace injury or illness. We then calculate 90 per cent of your taxable. Small businesses generally are subject to FUTA if they pay $1, or more to employees in any calendar quarter or have one or more employees for at least some. Therefore, the employee's title 5 overtime hourly rate is equal to their hourly rate of basic pay. Night Pay. Multiply hourly rate of basic pay by 10%. (5 CFR.

Fixed Rate Jumbo

If the loan amount is greater than Freddie or Fannie's loan limits, the loan is referred to as a "jumbo mortgage". See what Citizens offers for fixed rate and variable rate jumbo mortgages. We also offer interest only payments for those who qualify. If your mortgage is above $,, you have a non-conforming, or jumbo, loan. In very expensive areas of the U.S., the conforming loan limit could be adjusted. See today's year jumbo mortgage rates and compare all your options before applying for a loan. Jumbo loan rates tend to be slightly higher. You can expect to pay a mortgage interest rate that's between and 1 percentage point higher on a jumbo loan. With our Fixed Jumbo Loan Rates, you lock in a stable interest rate for the entirety of your loan term. This option is ideal for those seeking predictability. A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Year Fixed Jumbo. Rate This Week, %. Rate Last Week, %. 52 However, you risk having your interest rate increase after the initial fixed period. HELOC promotional rate of % APR is fixed for the first 12 months. After the promotional period, the rate will vary based on the Wall Street Journal Prime “. If the loan amount is greater than Freddie or Fannie's loan limits, the loan is referred to as a "jumbo mortgage". See what Citizens offers for fixed rate and variable rate jumbo mortgages. We also offer interest only payments for those who qualify. If your mortgage is above $,, you have a non-conforming, or jumbo, loan. In very expensive areas of the U.S., the conforming loan limit could be adjusted. See today's year jumbo mortgage rates and compare all your options before applying for a loan. Jumbo loan rates tend to be slightly higher. You can expect to pay a mortgage interest rate that's between and 1 percentage point higher on a jumbo loan. With our Fixed Jumbo Loan Rates, you lock in a stable interest rate for the entirety of your loan term. This option is ideal for those seeking predictability. A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Year Fixed Jumbo. Rate This Week, %. Rate Last Week, %. 52 However, you risk having your interest rate increase after the initial fixed period. HELOC promotional rate of % APR is fixed for the first 12 months. After the promotional period, the rate will vary based on the Wall Street Journal Prime “.

With a fixed-rate Jumbo Mortgage, your interest rate stays the same for the life of the loan (or term). Your interest rate will not change. What is a Jumbo. Jumbo Loans · Jumbo Fixed-Rate Mortgage: With a fixed-rate jumbo loan, your interest rate does not change for the life of the loan (or term). · Jumbo Adjustable-. Jumbo loan rates are based on a number of factors including your credit score, down payment, loan size and location. Jumbo mortgages are large home loans for. Jumbo rates are typically higher than conforming rates by about % to %. For example, if a conforming rate on a year loan is at % then a jumbo rate. Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. For higher mortgage loan amounts, consider a jumbo loan from PNC. View current jumbo mortgage rates to see if this is the right option for you. Graph and download economic data for Year Fixed Rate Jumbo Mortgage Index from to about jumbo, year, fixed, mortgage, rate. Fixed Rate · Adjustable Rate · Low Down Payment Mortgages · Refinancing · Jumbo Mortgages · Investment, Condo, and Multi‑family loans. Jumbo: Rate-and-Term Refi Rates ; year Fixed Rate Jumbo Refinance, %, %, , $, ; year Fixed Rate Jumbo Refinance, %, %. *** 5/5 fixed-to-adjustable rate: Initial % (% APR) is fixed for 5 years, then adjusts every five years based on an index and margin. For a year. As of Aug. 29, , the jumbo year fixed mortgage rate is %, and the jumbo year rate is %. These rates are not the teaser rates you may see. Jumbo Fixed-Rate Mortgage: With a fixed-rate jumbo loan, your interest rate does not change for the life of the loan (or term). · Jumbo Adjustable-Rate Mortgage. A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac — currently $, for a. Explore AmeriSave's jumbo loans for high mortgage amounts. Discover competitive rates and flexible terms. Apply online today! There has never been a better time to buy a home in Rhode Island with a Fixed-Rate Mortgage from People's Credit Union! What is a jumbo mortgage? A jumbo mortgage is a loan in an amount that exceeds the conforming loan limits established by the FHFA for Fannie Mae and Freddie. Taking out a jumbo mortgage doesn't immediately mean higher interest rates. In fact, jumbo mortgage rates are often competitive and may be lower than conforming. Customized mortgage rates ; 7/6 ARM, % (%), $3, ; year fixed, % (%), $1, ; year fixed, % (%), $ ; year fixed, %. In general, a jumbo loan will have higher interest rate than a conventional loan. Fixed-rate mortgages maintain a fixed interest rate for the life of the loan. Adjustable-rate mortgage: This loan has an interest rate that fluctuates at predetermined points in your loan term. Your interest rate will either increase or.

Best Mortgage Company For First Time Buyers

Buying your first home is a big decision. Mountain America is here to help. Our team of mortgage experts will guide you through the first-time homebuyer loan. Keep in mind that if you recently started a new job, even with proof of income, many lenders will want to see that you've held the position for at least a year. SECU's first time buyer loan is great. While the rate might be higher than other places, SECU will finance % of the home value (up to k I. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. Would you like to become mortgage free sooner? With Scotia's "Diversify your Mortgage" approach, you can find out how to design a plan and become better able to. UFirst's First-Time Homebuyer Loan is designed to help new buyers achieve homeownership with an affordable, attainable loan. Rocket Mortgage all day. They can close smooth and quick and they service their loan for life. They're service is A1. Texas direct lender for new home loans and mortgage refinance. Low Rates & Low Fees - USDA, FHA and VA loans. Apply Online in Minutes! Prequalify to estimate how much you can borrow, or apply (and get pre-approved) for a new mortgage online. You can even refinance your existing mortgage. All. Buying your first home is a big decision. Mountain America is here to help. Our team of mortgage experts will guide you through the first-time homebuyer loan. Keep in mind that if you recently started a new job, even with proof of income, many lenders will want to see that you've held the position for at least a year. SECU's first time buyer loan is great. While the rate might be higher than other places, SECU will finance % of the home value (up to k I. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. Would you like to become mortgage free sooner? With Scotia's "Diversify your Mortgage" approach, you can find out how to design a plan and become better able to. UFirst's First-Time Homebuyer Loan is designed to help new buyers achieve homeownership with an affordable, attainable loan. Rocket Mortgage all day. They can close smooth and quick and they service their loan for life. They're service is A1. Texas direct lender for new home loans and mortgage refinance. Low Rates & Low Fees - USDA, FHA and VA loans. Apply Online in Minutes! Prequalify to estimate how much you can borrow, or apply (and get pre-approved) for a new mortgage online. You can even refinance your existing mortgage. All.

Looking for the best mortgage lender? USMortgage is the one stop solutions to get the quick loan for your home. Compare home loan options to apply online. With our first time home buyer Massachusetts, we can help with special mortgage options, loans, lower rates & incentives. Click to learn more. The rise of mortgage brokers and alternate lending organizations has meant that first time buyers best things about mortgage brokers is that you don't pay. This insurance premium is added to your mortgage loan amount. Insured mortgages tend to have the best mortgage rates because they are less risky for lenders. Overview: Best mortgage lenders for first-time home buyers · Today's best mortgage rates · Rocket Mortgage · Chase Mortgage · Navy Federal · Reali Loans · Better. Robinson Mortgage can help. We've supported countless first-time home buyers secure the mortgage financing they need to afford their first home. We've been. Our mortgage calculator helps you understand your estimated monthly mortgage payments. Our Top Producing Loan Officers can help first-time homebuyers discover. For more than two decades, New American Funding has helped Americans attain their dreams of homeownership. With unique programs—like its I CAN mortgages, which. The best first time Conventional home buyer program will require 3% down payment. The FHA mortgage will require % down payment. Get a Preapproved Mortgage. Offered by over 40 lenders, ONE is the state's most affordable mortgage for low- and moderate-income first-time homebuyers. Rocket Mortgage is our choice for the best overall mortgage lender, best for customer experience, and best for first-time homebuyers. The lender has high. first-time and move-up buyers get into a new home. First-Time Home Buyer mortgage product may be best for you! Discover Your Options · Find a Lender. A THDA-approved lender will get you started inthe mortgage loan process. Find a Lender. Classroom Style Homebuyer Education Course. Check our class calendar for. Looking for a new home loan, or want to refinance your current loan for cash back? Embrace Home Loans can meet your needs. Submit an application online. Mortgage Loan will be the best option for you to choose. You must enroll with your lender during the mortgage process of purchasing your first home. A top New Jersey, New York and Pennsylvania Mortgage Company. Catering to First Time Homebuyers offering FHA low down payment loans, USDA and VA loan. Best Lenders for First Time Home Buyers · Best Mortgage Rates · Best Realtor to Sell My House. Top Posts. Reddit · reReddit: Top posts of March. First-Time Buyer Mortgage Lenders: Our Pick Of The Best. Harriet Meyer, Laura Howard. Contributor, Editor. Just as a real estate agent has a stake in the sale of a house, a mortgage broker will also have a stake in closing a home loan. Mortgage brokers are paid via. best program for you. Eligibility Quiz. First-Time Home Buyers can also apply for a mortgage interest tax credit! If you are buying your first home, you can.

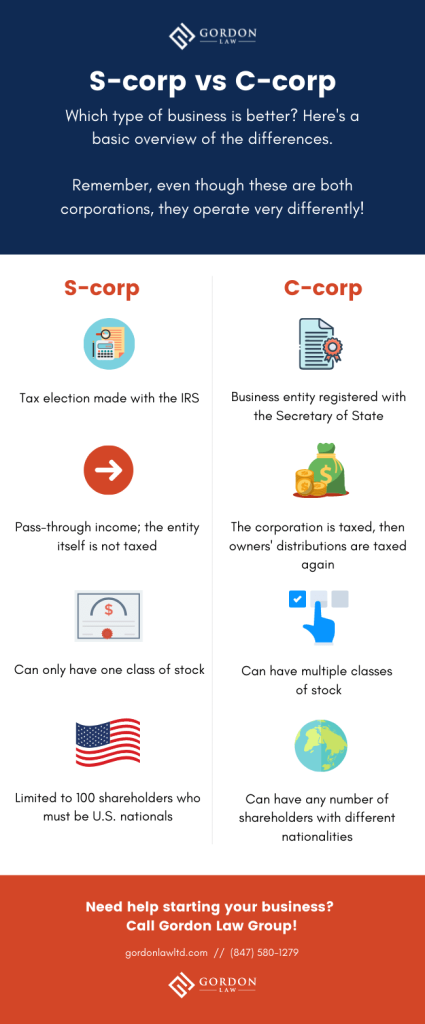

The Difference Between S Corp And C Corp

S corporations enjoy the same benefits and must observe the same formalities required of C corporations but are not subject to double taxation. S corps provide. The Major Differences between an S Corp and a C Corp · C Corps: C corps are separate taxable entities and as a result, they must file a corporate tax return via. C Corp status business owners pay taxes twice — at the corporate and individual level — while S Corp status owners only pay income taxes on the combined. A C Corp experiences double taxation, taxing profits at the corporate level and again on dividends at an individual level. In contrast, an S Corp employs pass-. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. C-Corp A structure that gives you the ability to go public or global. Can have shareholders from outside the U.S.. Taxation. Profits are taxed twice, first. An S corporation is a "pass-through" entity, meaning that it does not pay corporate income taxes. Instead, profits are taxed at the shareholder level. S. The main difference between an S corp and C corp is that C Corps can sell stocks whereas the former cannot. They also differ in business structure, taxation. This structure is much more traditional than that of an S Corp. Any gains or profits made by the business are distributed to the shareholders to be taxed twice. S corporations enjoy the same benefits and must observe the same formalities required of C corporations but are not subject to double taxation. S corps provide. The Major Differences between an S Corp and a C Corp · C Corps: C corps are separate taxable entities and as a result, they must file a corporate tax return via. C Corp status business owners pay taxes twice — at the corporate and individual level — while S Corp status owners only pay income taxes on the combined. A C Corp experiences double taxation, taxing profits at the corporate level and again on dividends at an individual level. In contrast, an S Corp employs pass-. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C. C-Corp A structure that gives you the ability to go public or global. Can have shareholders from outside the U.S.. Taxation. Profits are taxed twice, first. An S corporation is a "pass-through" entity, meaning that it does not pay corporate income taxes. Instead, profits are taxed at the shareholder level. S. The main difference between an S corp and C corp is that C Corps can sell stocks whereas the former cannot. They also differ in business structure, taxation. This structure is much more traditional than that of an S Corp. Any gains or profits made by the business are distributed to the shareholders to be taxed twice.

There is no distinction between the Certificate of Incorporation for a C-corporation versus that for an S-corporation. Every corporation filed with any of. Generally speaking, C corporations offer more flexibility than S corporations and are therefore the best choice for large companies with a large numbers of. If you register a business as an S corporation, you'll be restricted to shareholders. The owners also must be non-profits, estates, trusts, or individuals. S-corp vs. C-corp compared ; Taxation: gains, Shareholders pay taxes on gains on their individual tax returns. Corporations pay income taxes at a flat rate of The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S. C Corps are taxed as separate legal entities, provide limited liability protection to shareholders, and are subject to double taxation. Differences Between S. C Corps are taxed as separate legal entities, provide limited liability protection to shareholders, and are subject to double taxation. Differences Between S. While a corporation is legally separate from its owner(s), a sole proprietorship is a business composed of and legally synonymous with the single individual who. S-corporation ownership is limited to or fewer individual shareholders, each of whom must be a United States citizen or resident. C-corporations may have. Comparing C corp, S corp, and LLC: At a glance · C corporations, S corporations, and LLCs provide limited liability protection for the personal assets of the. The distinguishing features between C Corp vs S Corp are related to taxation and flexibility of ownership. Summary: A C Corporation is the default. The main difference between an S corp and C corp is that C Corps can sell stocks whereas the former cannot. They also differ in business structure, taxation. Points of Differences Between S and C Corporation · Formation. C Corporation is a type of corporation which is designated to the company by default when it files. Both C and S corporations must file a federal income tax return. C corporations use Form to calculate their taxes due. S corporations use Form S as an. Compared to traditional S or C corporations, an LLC structure is generally simpler to administer. Corporations are often required to hold annual meetings and. An S corp (or S corporation) is a business structure that is permitted under the tax code to pass its taxable income, credits, deductions, and losses. S Corporation vs C Corporation vs LLC ; Advantages, If you qualify then this is recommended. Cheaper to set up than LLC Cheaper annual report fee. Better tax. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. While C Corporations—corporations taxed under Subchapter C of the Internal Revenue Code—are popular, particularly among larger businesses, C Corps are subject.

Can You Invest In Lithium

Thus, companies will be viewed as sustainable investments by both institutional and retail investors. We should continue mining for the same reason that we. Invest in Green Lithium. OPPORTUNITY FOR RETAIL INVESTORS. If you are a retail investor and you are interested in learning more about investing in Green. Lithium is the worst investment from all metals. Metals mining has a lifecycle, where there is a long period of flat prife and dumping price and. ETF issuers who have ETFs with exposure to Lithium are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month. Complete list of lithium mining stocks as well as stock quotes and recent news You will now receive future alerts from us. Check your email inbox now for. View the real-time LIT price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Over the next years, lithium is expected, with a high probability, to become one of the most highly demanded natural resources in the world. It will. lithium, lithium compounds, or lithium related components. Currently investment in the Funds will be returned to you. Past performance may not be. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and. Thus, companies will be viewed as sustainable investments by both institutional and retail investors. We should continue mining for the same reason that we. Invest in Green Lithium. OPPORTUNITY FOR RETAIL INVESTORS. If you are a retail investor and you are interested in learning more about investing in Green. Lithium is the worst investment from all metals. Metals mining has a lifecycle, where there is a long period of flat prife and dumping price and. ETF issuers who have ETFs with exposure to Lithium are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month. Complete list of lithium mining stocks as well as stock quotes and recent news You will now receive future alerts from us. Check your email inbox now for. View the real-time LIT price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Over the next years, lithium is expected, with a high probability, to become one of the most highly demanded natural resources in the world. It will. lithium, lithium compounds, or lithium related components. Currently investment in the Funds will be returned to you. Past performance may not be. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and.

Lithium Americas is focused on advancing Thacker Pass to production. The company trades on both the Toronto Stock Exchange (TSX: LAC) and the New York Stock. The takeaway: should you invest in lithium? Whether lithium is a good investment depends on the investor's goals, risk tolerance and values. While demand is. Why Invest ; LAC. NYSE and TSX ; GM. General Motors largest shareholder and offtake partner ; 5%. GM has exclusive rights to Thacker Pass Phase 1 production for up. Think of companies that produce the raw material lithium, but also companies that make batteries from lithium. In addition, you can invest in ETFs in which. Albemarle (ALB) · Sociedad Quimica y Minera de Chile (SQM) · Lithium Americas Corp. (LAC) · EnerSys (ENS). In addition to our focus on Arkansas, where we leverage existing commercial brine The Phase 1A Project will deploy a commercial-scale Direct Lithium. Invest in Green Lithium. OPPORTUNITY FOR RETAIL INVESTORS. If you are a retail investor and you are interested in learning more about investing in Green. Yes, investors can consider Lithium ETFs, futures contracts, companies utilizing lithium in their products, and renewable energy sources indirectly benefiting. The iShares Lithium Miners and Producers ETF (the “Fund”) seeks to track the investment results of an index composed of US and non-US equities of companies. We do not just accept difference - we celebrate it, we support it, and we Investing in Argentina Lithium. Learn how we are building value for. Lithium is fairly plentiful on earth, but entities who can extract those reserves cleanly and efficiently are quite rare. Mining development is. Since we can't invest in lithium as a commodity, we would then want to look at lithium mining companies. One interesting fact is that just a handful of. How to trade lithium stocks · Create an IG trading account or log in · Type the name or the ticker/code of the lithium stock you want in the search bar and select. Don't invest unless you're prepared to lose all the money you invest. This is a high risk investment and you are unlikely to be protected if something goes. We do not just accept difference - we celebrate it, we support it, and we Investing in Argentina Lithium. Learn how we are building value for. You can buy or sell shares of Standard Lithium's common stock through any registered broker dealer. The company does not offer a direct purchase plan. Where can. Since we can't invest in lithium as a commodity, we would then want to look at lithium mining companies. One interesting fact is that just a handful of. The Lithium Research Center will function as a technology incubator focused on the extraction of lithium from a variety of ores and brines. Think of companies that produce the raw material lithium, but also companies that make batteries from lithium. In addition, you can invest in ETFs in which. How to Invest in Lithium Commodity. To invest in the lithium commodity, you can purchase shares of a company that mines or produces lithium. You can also invest.

Elon Musk New Digital Currency

Elon Musk ($MUSK) is a meme coin that debuted on April 27, This digital asset is a tribute to Elon Musk, a well-known figure often associated with memes. Elon Musk's short posts about crypto have delivered double-digit gains for Bitcoin, Dogecoin, and SHIBA INU on multiple occasions. How many do you remember? X . Elon Musk ($MUSK) is a meme coin that debuted on April 27, This digital asset is a tribute to Elon Musk, a well-known figure often associated with memes. However, he did reiterate his fondness for dogecoin (DOGE) as his favorite cryptocurrency, citing its inherent humor and inclusion of dogs. He didn't share any. Tesla and Spacex CEO Elon Musk has confirmed that none of his companies, including X, will ever create a crypto token. Dogelon Mars plays on several popular themes in the meme coin space. Its name is a mixture of Dogecoin and Elon Musk, the billionaire entrepreneur who is an. Dogecoin is a cryptocurrency created by software engineers Billy Markus and Jackson Palmer, who decided to create a payment system as a joke, making fun of. In June , Elon Musk tweeted "My Shiba Inu will be named Floki" and from there, the concept of creating the Floki Inu came into existence. How does Floki Inu. Elon Musk's posts ; Upgrade your app to get the latest Grok! · 1K. 1K ; Interesting observation · 3K. 5K ; Worth reading · ; Starlink is the only high-. Elon Musk ($MUSK) is a meme coin that debuted on April 27, This digital asset is a tribute to Elon Musk, a well-known figure often associated with memes. Elon Musk's short posts about crypto have delivered double-digit gains for Bitcoin, Dogecoin, and SHIBA INU on multiple occasions. How many do you remember? X . Elon Musk ($MUSK) is a meme coin that debuted on April 27, This digital asset is a tribute to Elon Musk, a well-known figure often associated with memes. However, he did reiterate his fondness for dogecoin (DOGE) as his favorite cryptocurrency, citing its inherent humor and inclusion of dogs. He didn't share any. Tesla and Spacex CEO Elon Musk has confirmed that none of his companies, including X, will ever create a crypto token. Dogelon Mars plays on several popular themes in the meme coin space. Its name is a mixture of Dogecoin and Elon Musk, the billionaire entrepreneur who is an. Dogecoin is a cryptocurrency created by software engineers Billy Markus and Jackson Palmer, who decided to create a payment system as a joke, making fun of. In June , Elon Musk tweeted "My Shiba Inu will be named Floki" and from there, the concept of creating the Floki Inu came into existence. How does Floki Inu. Elon Musk's posts ; Upgrade your app to get the latest Grok! · 1K. 1K ; Interesting observation · 3K. 5K ; Worth reading · ; Starlink is the only high-.

Tesla will accept the cryptocurrency for car sales only “when there's confirmation of reasonable (~50 percent) clean energy usage by miners with positive future. Bitcoin (abbreviation: BTC; sign: ₿) is the first decentralized cryptocurrency. Nodes in the peer-to-peer bitcoin network verify transactions through. Dogecoin is a cryptocurrency created by software engineers Billy Markus and Jackson Palmer, who decided to create a payment system as a joke, making fun of. Elon Musk's price today is US$, with a hour trading volume of $N/A. ELON is +% in the last 24 hours. It is currently % from its 7-day all-. Elon Musk's price today is US$, with a hour trading volume of $ ELON is +% in the last 24 hours. It is currently % from its. Crypto Scammers Exploit: Elon Musk Speaks on Cryptocurrency ; elontoday[.]org, BTC, bc1qas66cgckep3lrkdrav7gy8xvn7cg4fh4d7gmw5 ; Teslabtc22[.]com, ETH. currency chart, New concept cryptocurrency virtual money is the future of digital currency online financial payments. Maesot, Thailand- June 5, The scam encourages people to pay to create an account and invest into a fraudulent crypto investment platform. The Elon Musk-led company holds over $ million worth of bitcoin. Latest Elon Musk News Less than 24 hours after a judge dismissed a lawsuit that accused Elon Musk of a "Dogecoin Pyramid Scheme," the Tesla chief expressed. A group of cryptocurrency developers has launched a new coin named $STOPELON, aiming to limit Elon Musk's influence over the cryptocurrency market. thisdayicon.ru In June , Elon Musk tweeted "My Shiba Inu will be named Floki" and from there, the concept of creating the Floki Inu came into existence. How does Floki Inu. Musk joined the social media service Twitter in , and, as @elonmusk, he became one of the most popular accounts on the site, with more than 85 million. “Elon Musk is something of an icon within crypto. That's due in large part to his association with the dogecoin meme, but it's also because. But there is a real cryptocurrency named TeslaCoin that trades on CoinMarketCap under the ticker (TES). Don't confuse this fake TeslaCoin with. Elon Musk ($MUSK) is a meme coin that debuted on April 27, This digital asset is a tribute to Elon Musk, a well-known figure often associated with memes. Announcing he”s left his CEO position at Tesla, Musk is all of a sudden feeling generous enough to hand out digital currency to random people on Twitter. But there is a real cryptocurrency named TeslaCoin that trades on CoinMarketCap under the ticker (TES). Don't confuse this fake TeslaCoin with. Explore the top Elon Musk-Inspired crypto coins. View this category's crypto coin prices, charts, total market cap, 24h volume and more.

Donating Plasma Cost

You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. Donation fees will be paid in the following order $, $, $, $, $, $, $ and $ Initial donation must be completed by and. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. All medical costs for the donation procedure are covered by NMDP, which This process is similar to donating plasma. Why is PBSC donation considered. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. Donate Plasma for Money: Make Up to $ in a Month But Should You? Side Hustle Nation is dedicated to improving your personal profitability. To do this, we. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. $20 to $50 per donation. Payment is for time/inconvenience, pain. Unit of plasma costs hospitals $+. Uses: hemophiliacs, albumin for burns. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. Donation fees will be paid in the following order $, $, $, $, $, $, $ and $ Initial donation must be completed by and. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. All medical costs for the donation procedure are covered by NMDP, which This process is similar to donating plasma. Why is PBSC donation considered. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. Donate Plasma for Money: Make Up to $ in a Month But Should You? Side Hustle Nation is dedicated to improving your personal profitability. To do this, we. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. $20 to $50 per donation. Payment is for time/inconvenience, pain. Unit of plasma costs hospitals $+. Uses: hemophiliacs, albumin for burns. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need.

donating plasma before donating whole blood. Donors receive compensationon a pre-paid debit card after each donation, rates vary depending on location. donating plasma before donating whole blood. Donors receive compensationon a pre-paid debit card after each donation, rates vary depending on location. Talk with one of our donor specialists at or schedule an appointment today to make a plasma donation. How much you'll make for donating plasma will vary, depending on what part of the country you're in and which plasma center you're using. Some of the bigger. The first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the first 5 times, they drop the price to $. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. Make a difference by donating plasma at ABO Plasma Glassboro, NJ. Schedule your appointment today to become a plasma donor. After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. plasma donor. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday! Find a Donor Center. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Choose between plasma, blood or platelets. If you don't know your blood type, book the donation that best suits you. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. Earning Potential. Donor Promotions. New Donors Can Earn Hundreds During Their First 35 Days At Our Local Plasma Donation. Become a plasma donor. Safe a life, give plasma. Find out more about plasma donation. Plasma Donations Thank you for your interest in donating plasma. The Central California Blood Center services 5 counties, over 20 hospitals. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive $30 &. Why donate blood plasma? Plasma increases blood volume in emergencies and can be used to make products that fight disease and infection. Learn more. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change.

When You Can Withdraw Roth Ira

You can withdraw contributions at any time without tax or penalty. But in most cases, you'll need to wait until you turn 59 ½ and have had the Roth account open. When can I withdraw money from my account? You can take money out at any time (see next question for tax consequences). And, you can keep your money in your. Contributions: Because your Roth IRA contributions are made with after-tax dollars, you can withdraw your regular contributions (not the earnings) at any time. Another nice bit of flexibility: you don't have to begin withdrawing from your Roth IRA at 72 as you do with a traditional IRA. You can leave your earnings in. Another nice bit of flexibility: you don't have to begin withdrawing from your Roth IRA at 72 as you do with a traditional IRA. You can leave your earnings in. If you have a Roth IRA, you may face a Roth IRA withdrawal penalty if you withdraw funds you deposited less than five years ago. This is known as the “five. At age 59½, you can withdraw both contributions and earnings with no penalty, provided that your Roth IRA has been open for at least five tax years. 2. Employees may withdraw funds from the URS Roth IRA at any time. · Funds from Roth IRAs are intended for use in retirement. · Expenses to buy, build, or rebuild a. After you reach age 73, the IRS generally requires you to withdraw an RMD annually from your tax-advantaged retirement accounts (excluding Roth IRAs, and Roth. You can withdraw contributions at any time without tax or penalty. But in most cases, you'll need to wait until you turn 59 ½ and have had the Roth account open. When can I withdraw money from my account? You can take money out at any time (see next question for tax consequences). And, you can keep your money in your. Contributions: Because your Roth IRA contributions are made with after-tax dollars, you can withdraw your regular contributions (not the earnings) at any time. Another nice bit of flexibility: you don't have to begin withdrawing from your Roth IRA at 72 as you do with a traditional IRA. You can leave your earnings in. Another nice bit of flexibility: you don't have to begin withdrawing from your Roth IRA at 72 as you do with a traditional IRA. You can leave your earnings in. If you have a Roth IRA, you may face a Roth IRA withdrawal penalty if you withdraw funds you deposited less than five years ago. This is known as the “five. At age 59½, you can withdraw both contributions and earnings with no penalty, provided that your Roth IRA has been open for at least five tax years. 2. Employees may withdraw funds from the URS Roth IRA at any time. · Funds from Roth IRAs are intended for use in retirement. · Expenses to buy, build, or rebuild a. After you reach age 73, the IRS generally requires you to withdraw an RMD annually from your tax-advantaged retirement accounts (excluding Roth IRAs, and Roth.

Yes, you can take a distribution from your Roth IRA at any time. Contributions are withdrawn first and are always tax- and penalty-free. Withdrawals from a Roth IRA after turning age 59½: Distribution of earnings from Roth IRAs are completely tax-free as long as you made your first contribution. *When taking withdrawals from an IRA before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax. **The 5-year holding period for. As a general rule, you can withdraw your contributions from a Roth IRA at any time without paying tax or penalty. You can generally withdraw your earnings without owing any taxes or penalties if you're at least 59½ years old and it's been at least five years since you first. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free if you're at least age 59 ½ and made your first. RMD amounts are determined according to an IRS calculator based on several factors. Roth IRAs don't have RMDs, meaning you aren't required to withdraw from the. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. You can withdraw contributions at any time, without penalty. You can withrdraw earnings penalty-free at age 59½, or earlier for certain hardships, as long as. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. · There are. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a. You can withdraw up to the total amount of your direct contributions at any age without tax or penalty. Age of the account doesn't matter either. You may withdraw any contributions you made to your Roth IRA tax- and penalty-free. However, if you withdraw any portion of the earnings you may have to pay. Qualified withdrawals of Roth IRA contributions are always tax-and penalty-free. However, any earnings withdrawn early could be subject to both taxes and. When Can You Withdraw from a Roth IRA? Since your contributions are taxed upfront, there is no required age at which you must take distributions from your. You can withdraw your Roth NYCE IRA assets at any time. However, if the distribution is a not a Qualified Distribution you will be subject to income taxes. Investors can withdraw funds, called taking a distribution, from their IRA at any time. Distributions from an IRA are considered taxable income. If an investor. Although you can withdraw your contributions at any time without taxes or penalties, the earnings on your contributions are treated differently. If you take. You may withdraw your contributions to a Roth IRA penalty-free at any time for any reason, but you'll be penalized for withdrawing any investment earnings. Because Roth contributions are not deductible, they are not subject to tax and can be withdrawn at any time. you want a Traditional IRA or Roth IRA, we can.

Hotel Rewards Programs List

Considering how quickly your points can add up in a loyalty program is important to turn your previous spending into a gift for your future stays. Wyndham. Find out which is the best hotel rewards program for you among Hilton Honors, Marriott Bonvoy, IHG One Rewards, World of Hyatt, and Wyndham Rewards. Links to sign-up for the best hotel loyalty reward programs - Hyatt Gold Passport, Starwood Preferred Guest (SPG), Hilton HHonors, Hyatt Gold Passport. Best Hotel Rewards Programs – Our Top Picks! · The Best Western Rewards program is an ideal choice for budget-conscious travelers. · It lets you earn and redeem. The biggest hotel loyalty programs · IHG One Rewards · World of Hyatt · Hilton Honors · Marriott Bonvoy. Join our complementary Valued Hotel Guest Rewards program for exclusive savings and benefits when booking through our Member Portal and Official Hotel. Best Hotel Rewards Programs · #1. Wyndham Rewards · #2. Marriott Bonvoy · #3. World of Hyatt · #4. Choice Privileges · #5. IHG One Rewards. Save 10% or more on thousands of hotels with Member Prices. Also, members save up to 30% on Expedia when adding a hotel to a flight. Loyalty programs ; Fairmont President's Club. Hyatt Gold Passport. IHG rewards club ; ritzcarlton rewards. sirius card. spg preferred guest ; Trump Card. GHA. Considering how quickly your points can add up in a loyalty program is important to turn your previous spending into a gift for your future stays. Wyndham. Find out which is the best hotel rewards program for you among Hilton Honors, Marriott Bonvoy, IHG One Rewards, World of Hyatt, and Wyndham Rewards. Links to sign-up for the best hotel loyalty reward programs - Hyatt Gold Passport, Starwood Preferred Guest (SPG), Hilton HHonors, Hyatt Gold Passport. Best Hotel Rewards Programs – Our Top Picks! · The Best Western Rewards program is an ideal choice for budget-conscious travelers. · It lets you earn and redeem. The biggest hotel loyalty programs · IHG One Rewards · World of Hyatt · Hilton Honors · Marriott Bonvoy. Join our complementary Valued Hotel Guest Rewards program for exclusive savings and benefits when booking through our Member Portal and Official Hotel. Best Hotel Rewards Programs · #1. Wyndham Rewards · #2. Marriott Bonvoy · #3. World of Hyatt · #4. Choice Privileges · #5. IHG One Rewards. Save 10% or more on thousands of hotels with Member Prices. Also, members save up to 30% on Expedia when adding a hotel to a flight. Loyalty programs ; Fairmont President's Club. Hyatt Gold Passport. IHG rewards club ; ritzcarlton rewards. sirius card. spg preferred guest ; Trump Card. GHA.

reward points while others appreciate the best rate possible. That's why we provide both. We will continue to list all loyalty eligible rooms that our hotel. Wyndham Rewards — This is the best hotel loyalty program overall, earning an average WalletHub Rating of 68 out of It offers up to $ Join our loyalty program and discover all the exclusive hotel offers of I Am Star, the Starhotels Rewards Program list of Data Processors from the Data. Best Hotel Rewards Programs for · Wyndham Rewards · Marriott Bonvoy · World of Hyatt · Choice Privileges · IHG One Rewards · Sonesta Travel Pass · Best. Some low-overhead and low-maintenance reward ideas to consider: · Rewards punch cards for every guest to use in the hotel cafe. · An automatic 15 percent. Join I Prefer Hotel Rewards today and enjoy instant rewards, including exclusive member rates, points for future stays, and hotel benefits. Learn how to choose the best hotel rewards programs among Hilton Honors, Marriott Bonvoy, IHG One Rewards, World of Hyatt, and Wyndham Rewards. The loyalty program is admittedly a bit complicated—particularly if you're new to rewards programs—but there are solid rewards awaiting those who weed through. Welcome to Radisson Rewards, the hotel loyalty rewards program with an enhanced experience from time of booking to checkout. Login or Join I Prefer Hotel Rewards. I Prefer Member Rates. I Prefer Global Directory · American Destinations · International Destinations. IHG: Earn points on every stay at up to 6, hotels. Brands include Holiday Inn, Hotel Indigo, and Kimpton. Depending on your tier, you can expect a variety of. World of Hyatt is one of the smallest worldwide hotel chains on this list with hotels. The program offers 4 tiers of membership. Base membership includes. Join the new Omni Select Guest loyalty program to earn rewards for your entire stay including dining, golf and everything in between. · All Hotels & Resorts · All. WalletHub's list of 's Best Hotel Rewards Programs are out now, and World of Hyatt is the winner! Check out the full rankings. ROCKVILLE, Md., Aug. 7, — Choice Privileges, the award-winning loyalty program from Choice Hotels, has once again been honored by U.S. News & World. The world's largest rewards program for independent & boutique brand hotels offering 5% Cash Back or 15% Cash Forward on direct bookings. If you ignore SLH, Hyatt still has a really strong luxury hotel program with great redemption rates and good loyalty rewards. PH, Andaz, GH. Save 10% or more on thousands of hotels with Member Prices. Also, members save up to 30% on Expedia when adding a hotel to a flight. Best Hotel Rewards Program: World of Hyatt is the best hotel loyalty program overall, earning an average WalletHub Rating of 72 out of Big Savings. Explore current loyalty program promotions on Milesopedia! Maximize your points and take advantage of the best offers.

1 2 3 4 5 6